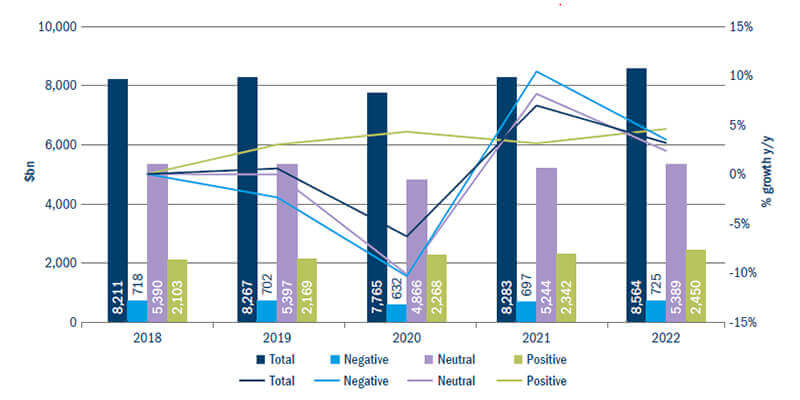

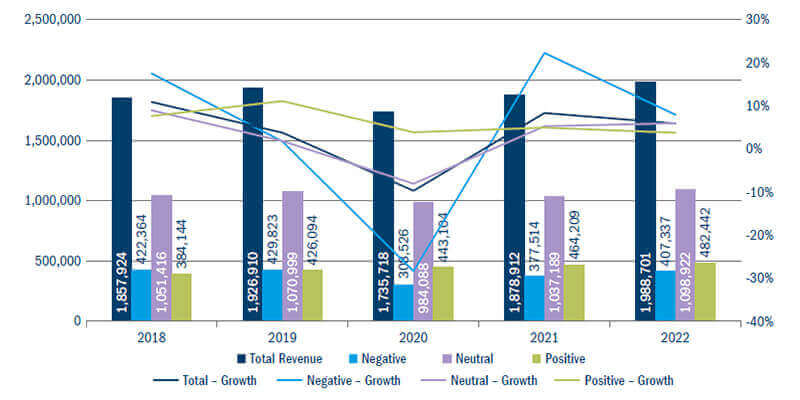

Negative, unchanged and positive impacts

When it comes to evaluating the winners and losers resulting from Covid-19, studying underlying business models is more revealing than reviewing traditional sectors. Conventional industry classifications, or codes, have become less insightful as company business models have evolved. For example, is Amazon a technology company, a retailer or both? Now, Covid-19 will alter long-term customer behaviour and change the nature of their transactions.

Having different perspectives and debating different views within the Columbia Threadneedle Investments research team often delivers the greatest insights. In the past few years, the research team has been re-orientated and expanded to focus on the areas where we can add most value for clients. Among other areas, we have expanded the data science team and the responsible investment (RI) team.

Our research teams have split business models into three groups, identifying how the shifts in consumer behaviour resulting from Covid-19 are likely to impact their recovery prospects.

Broadly speaking, the three categories are:

- Negative impact – business model not expected to recover to pre-Covid-19 levels, for example traditional retail.

- Unchanged – business model expected to recover to Covid-19 levels, for example pharmaceuticals.

- Positive impact – business model expected to exceed pre-Covid-19 levels, for example internet retail.

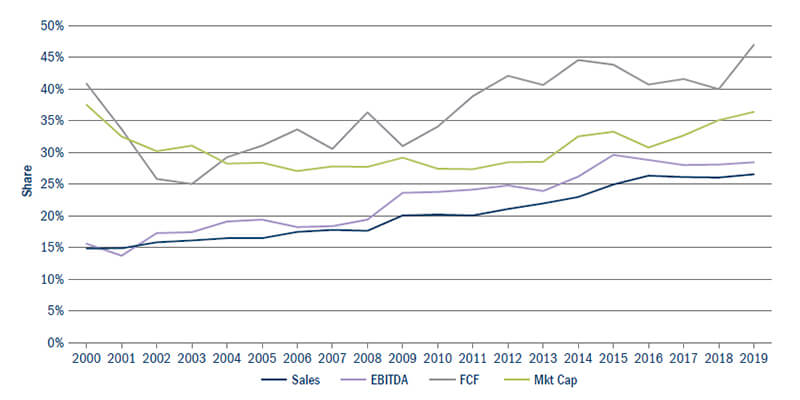

To a certain extent, the crisis has accelerated long-term trends that were in place beforehand. If there were three areas it was important to understand before the crisis, they were technology, healthcare and the financial ecosystem. As the pandemic accelerates existing economic and social trends, it has magnified the importance of these three themes. Technology and healthcare will be key sources of future sustainable growth. The figure below highlights fundamental share gains over the past 20 years. Finally, understanding financial liquidity is critical, not so much for discovering banks to invest in, but because readily available capital greases the global economy. The soundness of the financial system is critical for all businesses. Identifying potential pain points, identifying key investment risks and opportunities.

Figure 1: tech & healthcare share % of fundamentals & mkt cap

Russell 1000 ex financials, utilities, reits

Source: Columbia Threadneedle Investments, Compustat, Bloomberg as at May 2020.

Discovering opportunities and challenges that the market has overlooked would not be complete without RI or environmental, social and governance (ESG) research, particularly because the pandemic has highlighted social issues. ESG is a non-financial measure of a company’s quality that complements financial analysis. It reveals how well a company has thought about elements of its operations, including the quality of the management and rigour of the governance structure. It signals how well a company is likely to be able to grow organically, as well as how adaptable and innovative it is likely to be.

After Covid-19, social issues will be more important, with major implications for businesses. Columbia Threadneedle Investments’ RI analysts work closely with the fundamental equity and fixed income analysts to engage companies and to learn about how companies are responding to heightened sensitivity towards social issues. In a recent engagement call with Amazon, addressing the news surrounding their handling of Covid-19 and employee wellbeing, management detailed plans around keeping employee health and wellbeing at the forefront as a priority during this time period.

A time for forward-looking, independent research

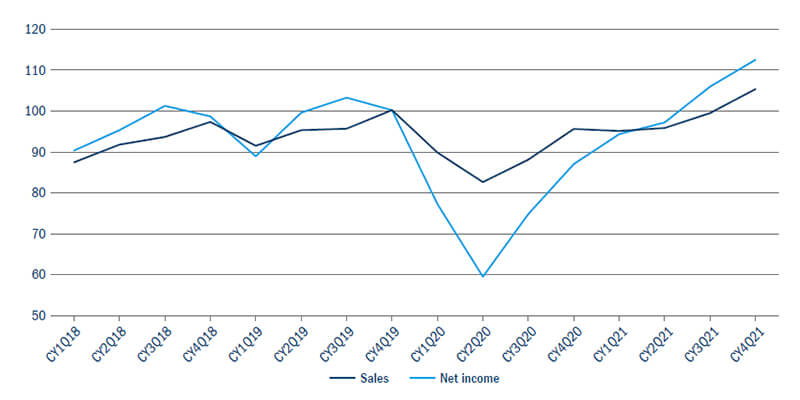

Figure 2: aggregate quarterly sales & net income

Indexed to 4Q19

Source: Columbia Threadneedle Investments, May 2020.

But as the estimates from the investment grade and high yield fixed income teams highlight, the recovery is not expected to be even across all business models, with those identified as being negatively impacted by Covid-19 struggling to recover over the next three years

Figure 4: revenue & growthe

This pandemic is a big moment for economies, a rare event that truly deserves to be described as a crisis. Analysing its impact on different business models with a laser focus is where the opportunity to uncover value lies. Covid-19 is a true gamechanger that presents active investment managers with a challenge, as well as the opportunity, to discover the varying effects and position portfolios accordingly. More than ever, now is a time when original, forward-looking, independent research will be critical in pursuing consistent investment returns.